In the category of items that are generally on the commercial solar market. By email I would be fragmented, but there is no single transaction for a mild Swingtrader to set up. In addition, we take into account the fact that the title is valid in our own “higher” perspective.

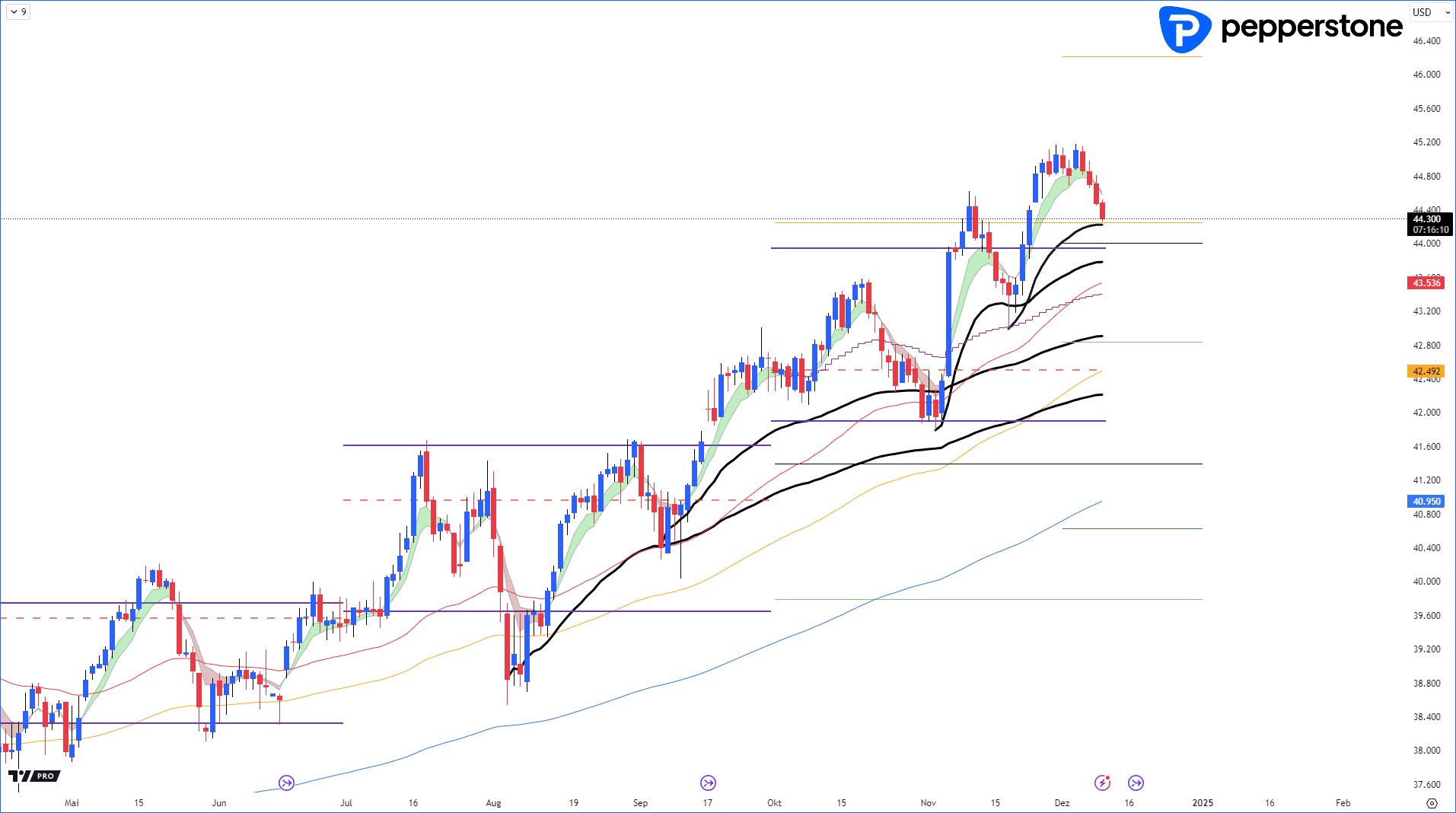

DOW JONES – D1 Chart | AKTUELL Value range High

The effect of DOW JONES in a short period. Look at the index based on the High value area on a quarterly basis. It is for Longtrades that it is not a good choice to take a different course. Of course it is a market phase, in the long and dynamic course of the VA (Value Area). Ebenso gibt es vale Beispiele, wo das NICHT gut geht. Durchschnittlich betrachtet, ist a risk-taking zone and therefor comes is one. Kurzfristige reactions and volumetric weight food Durchschnitten (black lines) are for Kurzfristige! Trading activities. The longer lifespan was reached in August by 42,900 points. Wirklich is the longest time of the Tages-EMA-200, which does not yet have German verläuft.

Mittelfristige Unterstützungen: 43,700 | 42,900 | 42,200 | 41,000 Punkte

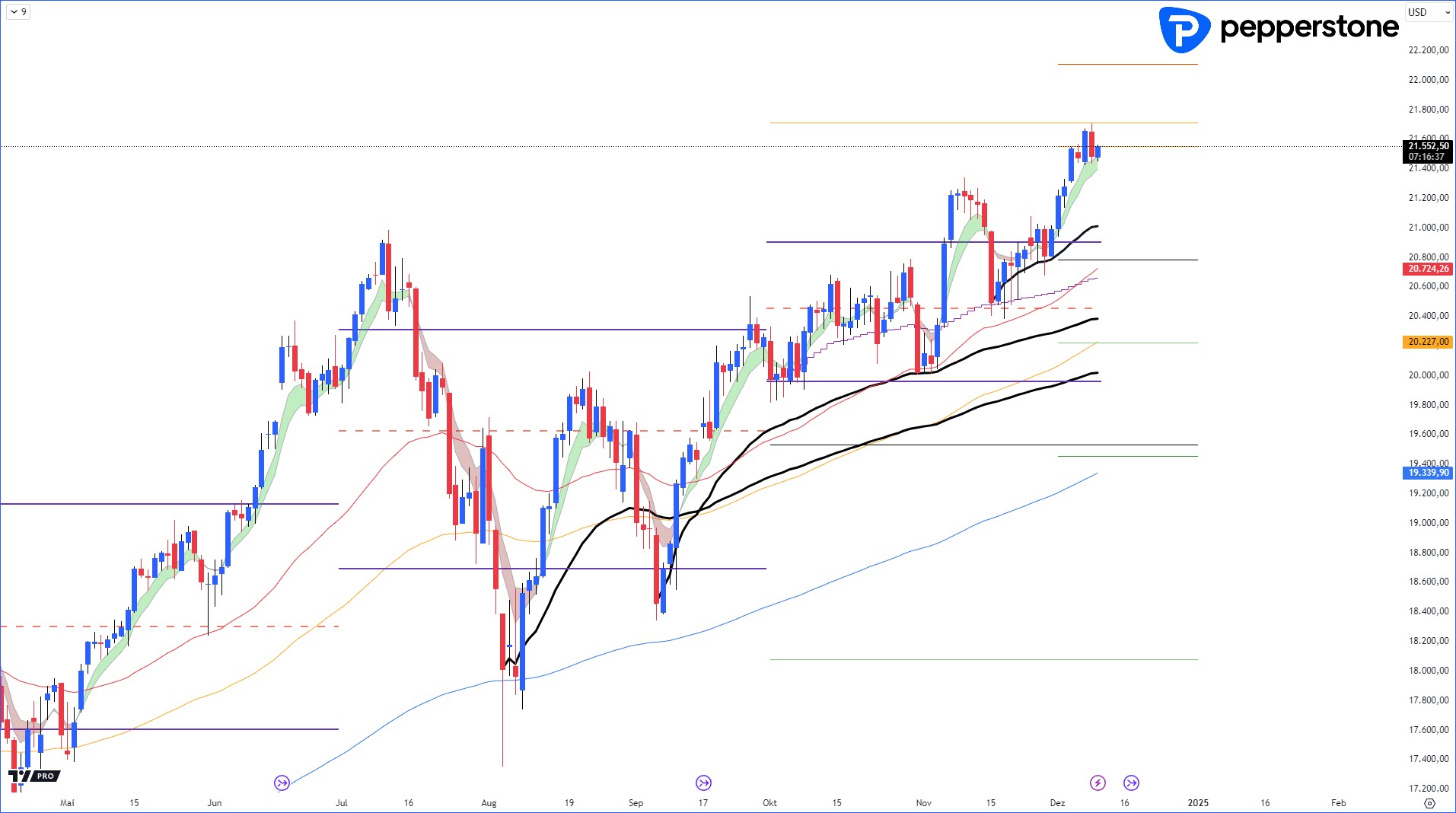

NASDAQ100 – D1 Chart | AKTUELL Value range High

When the NASDAQ100 discovers that it has run out of momentum, the DOW JONES becomes correct. There is a warning for the NASDAQ100. Die in Schwarz reformgehobenen Linien sind volumenweegete Durchschnitte. Darauf schauen institutional Investors. Before the background of the German market is shown, the distance to the “Anchored VWAPS” (Volume Weight Eating Durchnitten) as well as the Preislichen Durchschnitten (Tages-EMA-100 as Tages-EMA-200) is entfernt, (zu) weit entfernt. Gerade for Swingtrader, the longer term, is not a smart einkaufskurse. Particularly favorably gold-plated on the market and/with the Tages-EMA-200.

Mittelfristige Unterstützungen: 21,200 | 20,380 | 19,950 | 19,360 Punkte

Fell Erfolg,

Ihr Dennis Gürtler.

Dennis Gürtler is Gründer- and Geschäftsführer of a private trading company in Berlin. As a former Portfolio Manager and Vollzeithändler, he has been active in the financial market since 2008. Dennis Gürtler has been working in DACH-Raum for his expertise for 15 years.

Leave a Reply