Michael Burry has taken the next step: After his major coup in 2008, The Big Short started his career. The US Hedge Fund manager has won one (!) million won with a short-term profit on the US mortgage market. Bei der jüngsten Offenlegung seines Portfolios are extremely positioned in a best market position in August.

Some of the shares of the major Wall Street player (min. 100 million US dollars in assets) are portfolios in most 13F filings. Gerade for the private sector is one of the most important things that is ‘Big Money’ related. Stehen bestimmte Titel op de Kauflisten more Grossinvestoren, sollten sie more as nur einen zweiten Blick wert sein.

Often, ‘Smart Money’ takes a long time to expand the large amount of money with small market capitalization, one of the return potential that comes completely from the market. Do this at an Auswahl von over 16,500 (!) titles verlieren Anleger schnell de overblick and the risks of a fehlkaufs are enormous. Since then, the two Borsen experts Golo T. Kirchhoff and Steffen Härtle have developed a successful system.

Ihr System filters all relevant data, compares investments based on 13F applications and creates a consolidated list of top 50 candidates. Daraus lets the experts in their top company with their higher potential ab. If you follow the legends of Buffett, Burry, Wood and Co and who makes these woolly investments, join them in watching new Börsenletter “13F-Merichte” four times over 120 pages of research.

Provided exclusive Black Friday deal Save your money for a few years of 20 prozent and zahlen nur 100 Euro pro Ausgabe (400 Euro in Premium-Jahresabo). Sichern Sie sich gleich hier 20 Prozent Rabatt.

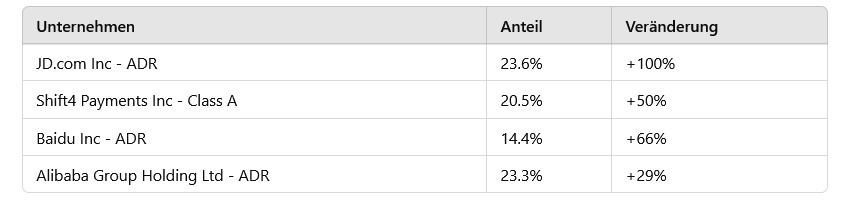

The young 13F edition of Burry’s active law: I letzten Quartal hat er sein Engagement in China-Aktien massiv ausgebaut. Mittlerweile beträgt der China-Anteil in Burrys Portfolio über 60 Prozent! With Alibaba, JD.com and Baidu, a Top-Holdings set of Mr. Big Short more of the history of the Chinese economy. Sollten Anleger ihm jetzt follow?

The clean data and management of the Hedge Fund manager will now be charged with a larger supply if the trade is executed. Gerade Burry has grown in the course of 2008 to what it is now. Given the extreme political risks that such high engagement in China entails.

Who knows more about the Köpfee from Wall Street for the reviews of Wochen who has a top chance in the field of Börsenprofi’s from the 13F-Filings that are possible, foutahren Sie im new Börsenletter „13F-Berichte“.

JETZT PROFIT

Tribal circle

Michael Burry’s top holdings

Leave a Reply